ATTENTION: Business OWners!!!!

The Greatest Opportunity of a Lifetime.....

"100 Business Owners Lives Will Change in 2025...."

"How Much Capital Is Your Business Losing Without You Even Knowing"

The Model That Didn't Exist - Until Now!

Break Free From The Grind - Join a Powerful Network of Entrepreneurs Creating Real Wealth and Real Impact!

CLICK BELOW TO WATCH FIRST!

Free Report For Business Owners Looking to Safeguard Their Financial Future and Maximize Profitability....

FREE GUIDE REVEALS......

Uncovering Hidden Financial Mistakes That Could Be Crippling Your Business

Discover costly financial oversights that most businesses miss and how our proprietary model identifies them before they cause damage.

Learn how to recapture lost capital that can be immediately reinvested into your business or added to your personal income.

Access practical strategies developed specifically for business owners who want concrete financial planning that delivers measurable results.

Over 1,023 Companies Nationwide Rely on Wellington Capital Management

About Us

Wellington Capital Management

Wellington Capital Management is a full-service Business financial planning firm dedicated to helping individuals, families, and business owners build, protect, and transfer wealth with purpose. As a Public Benefit Corporation, we proudly integrate profit with purpose—donating a portion of our revenue to underserved communities and causes we believe in.

We specialize in business financial planning, retirement strategies, insurance-based wealth solutions, estate and succession planning, and tax-efficient investment strategies. Guided by strong values, a holistic approach, and a deep commitment to financial education, we work to uncover hidden inefficiencies, reposition capital, and create long-term impact for our clients and their legacies.

Identify and Eliminate Financial Inefficiencies

Reposition Capital for Growth and Protection

Prepare for Exit, Succession, and Legacy

What Business Owners are Saying...

“I wish I’d found this before it almost cost us everything.”

"Using their unique financial planning model, we identified three critical mistakes in our business operations. After implementing the recommended changes, we recovered over $45,000 in capital that we've now reinvested in growth initiatives. Their approach is unlike anything we've seen before."

- Long Tao., CNC Machine shop founder- Ultimate precision tech

“It felt like someone finally handed me the missing pieces of the puzzle.”

"Their financial planning model revealed financial inefficiencies we never would have found on our own. After following their guidance, we not only fixed the issues but also freed up significant capital that improved both our business operations and my personal finances. The ROI has been extraordinary."

- Tom B., CFO- Frontier Logistics

“I thought we had our finances under control—until this report showed me otherwise.”

"Wellington Capital’s business financial planning process was a total game-changer for us. They uncovered missed tax advantages, overfunded insurance policies, and unused capital. Within 60 days, we restructured our cash flow, lowered liabilities, and increased profitability without increasing sales. I wish we had done this years ago."

— Michael R., Construction Business Owner

“What started as a quick check became a complete game-changer for our bottom line.”

"As a small business, we didn’t realize how much money we were leaving on the table until Wellington’s team broke down our financial structure. Their model not only identified inefficiencies, but also showed us how to reallocate funds into high-performing strategies. The savings and peace of mind have been priceless."

— Sarah T., Creative Agency Founder

STILL NOT SURE?

Frequently Asked Questions

Question 1: What is business financial planning, and why is it important?

Business financial planning is a strategic process that helps identify inefficiencies, reduce financial risk, maximize profitability, and plan for sustainable growth. At Wellington Capital Management, we use a proprietary model to uncover hidden issues that could cripple your business and create a custom roadmap to optimize your financial future.

Question 2: What makes Wellington’s business financial planning model different?

Our model was developed because traditional financial planning methods did not address the real risks and gaps we saw in small to mid-sized businesses. We offer a holistic, values-driven approach that looks at operations, taxes, capital structure, insurance, succession planning, and more—all aligned with your goals.

Question 3: Who is this service best suited for?

We primarily serve business owners, real estate investors, and entrepreneurs who are looking to grow, protect, or eventually exit their businesses. Our ideal clients are those who care about long-term wealth, legacy planning, and minimizing tax liabilities.

Question 4: Do you only work with large businesses?

No. We specialize in helping small to mid-sized businesses that are often underserved by traditional advisory firms. Whether you’re doing $250,000 or $25 million in revenue, we can help you find overlooked opportunities.

Question 5:How does the planning process work?

It starts with a discovery session where we assess your financials, structure, and goals. We then analyze the data through our proprietary framework to identify critical gaps. From there, we provide you with a clear action plan to address inefficiencies and improve your bottom line.

Question 6: Is there a cost to get started?

We offer a complimentary initial consultation. After that, our planning services are customized and can be structured as flat-fee, retainer, or performance-based depending on the scope of work.

Question 7: Do you offer help with taxes and compliance?

Yes. While we are not CPAs, we work alongside your CPA or introduce you to vetted tax professionals to ensure your planning aligns with tax-saving strategies. We also assist with business compliance reviews and legal structure optimization.

Question 8: Do you help with exit strategies and succession planning?

Absolutely. A major part of our value lies in preparing your business for sale, succession, or retirement. We help you create buy/sell agreements, perform valuations, and connect you with strategic or financial buyers.

Question 9: How often do we meet or update the plan?

That depends on the level of service you choose. Most of our clients meet quarterly for review, but some prefer monthly or biannual check-ins. We remain flexible to your needs.

Question 10: What industries do you specialize in?

We work across many sectors, including real estate, construction, healthcare, logistics, retail, and professional services. Our model is designed to adapt to different industries.

We Work with Some of The Largest Companies in the United States

STILL NOT SURE?

Frequently Asked Questions

Question 1: “I already have a CPA/bookkeeper.”

We work alongside your CPA and uncover strategic gaps they may not focus on—like long-term risk, succession, or capital optimization.

Question 2: “I don’t have the time.”

Our streamlined process is built for busy owners—we do the heavy lifting, and our findings can actually free up your time and energy.

Question 3: “I can’t afford this right now.”

What’s the cost of not planning? We find missed opportunities that often far outweigh the investment.

Question 4: “We’re doing fine already.”

Most businesses we help are already profitable—we simply help them do even better and prepare for growth or sale.

Question 5: “This sounds too complicated.”

We break everything down into simple action steps. No fluff, just clear answers and real results.

Question 6: “I’ve tried something like this before and it didn’t help.”

Our model is proprietary and practical—we don’t give generic advice. We diagnose, fix, and walk alongside you.

Question 7: “I don’t want to share all my financials.”

Your information is always confidential. We sign NDAs and only use the data to help you uncover hidden value.

Question 8: “It’s not the right time.”

The best time to plan is before you need to. Planning during calm seasons avoids chaos when challenges hit.

Question 9: “How do I know this will work for my industry?”

Our model is industry-agnostic and customizable—we’ve helped businesses in real estate, healthcare, service, construction, and more.

Question 10: “I’m not ready to exit or sell my business yet.”

Exit planning is long-term wealth planning. The earlier you start, the more options and value you’ll have.

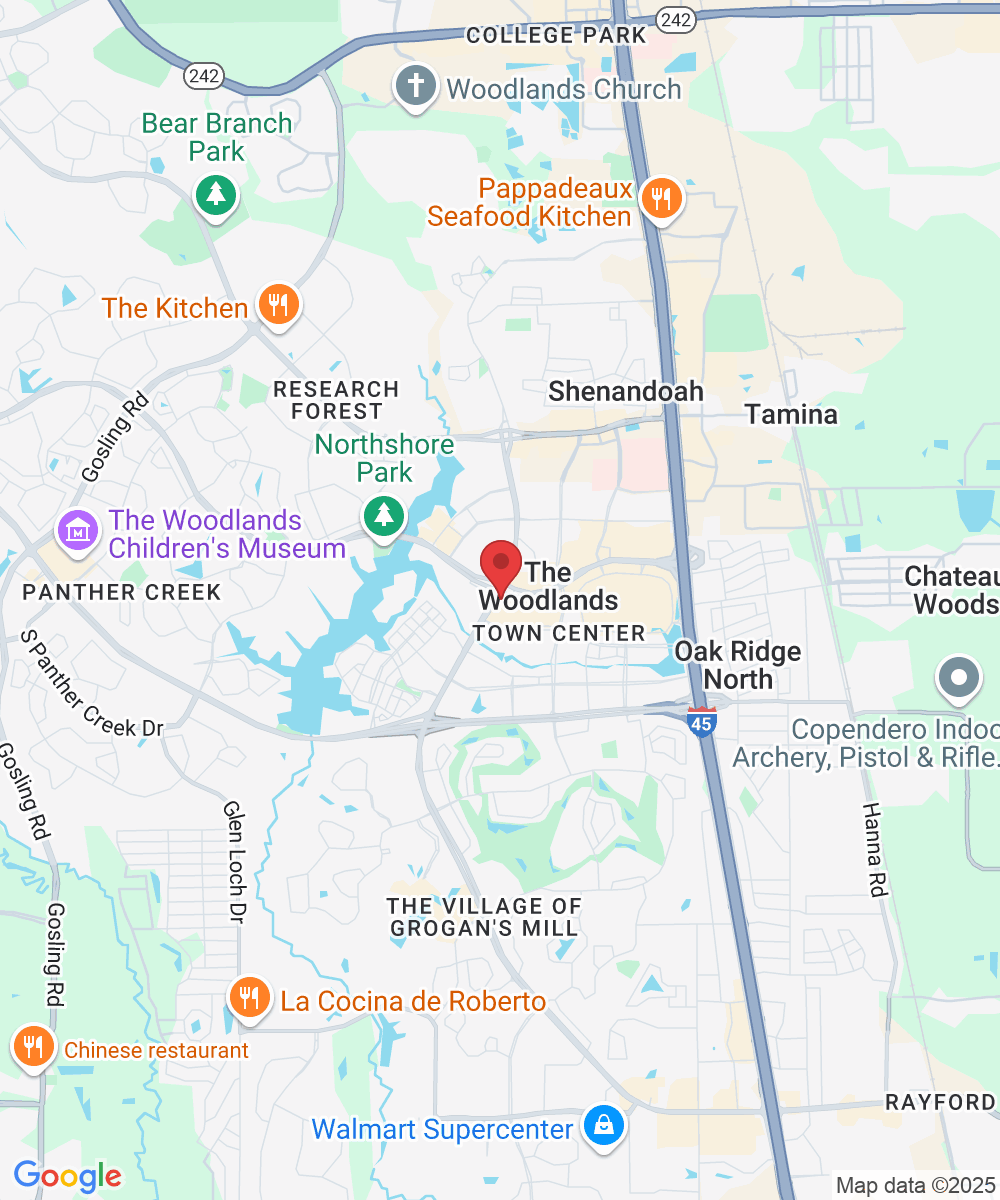

Shop: 9595 Six Pines Dr. The Woodlands Tx, 77380

Call: 346-309-6977

Email: James.WellingtonCapitalmgmt.org

Site:

www.WellingtonCapitalManagement.Org